Restricted Cash Compensating Balances, Calculation, Example

If a borrower has options from multiple lenders, they can negotiate a lower balance. Compensating balances are a unique aspect of loan agreements, impacting the borrower’s financial health and the lender’s risk management. Everyone involved can make informed decisions by understanding their role and proper accounting treatment.

How confident are you in your long term financial plan?

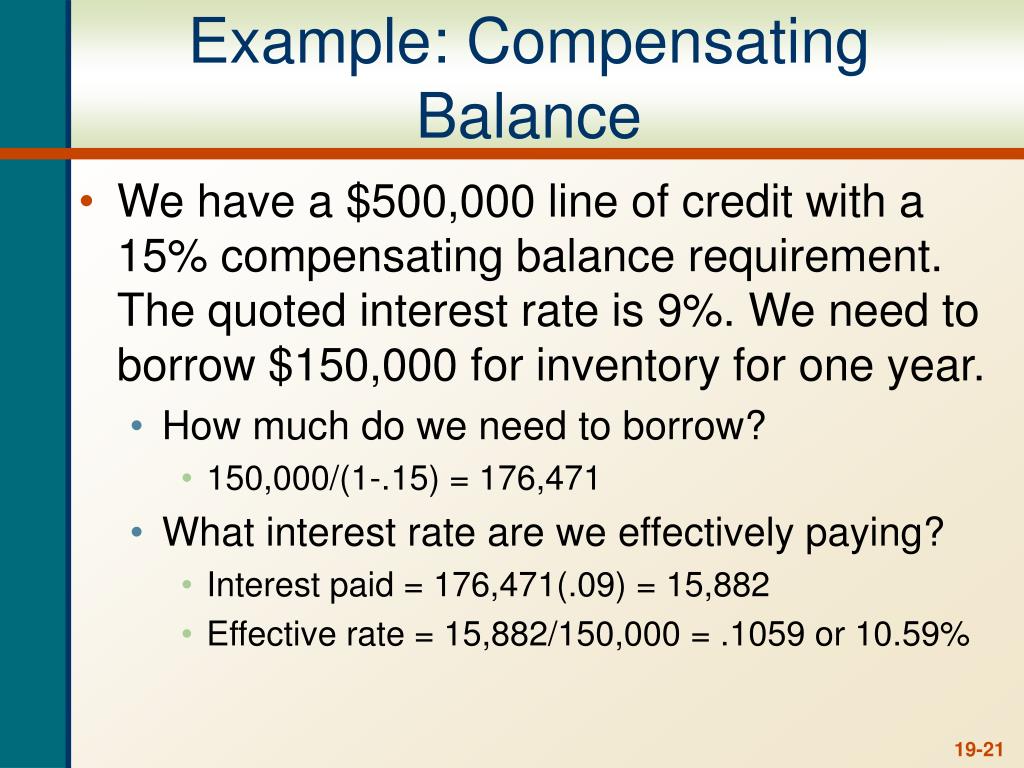

You would end up paying interest on a $60,000 loan to receive the $50,000 you originally needed. Have you ever taken out an instalment loan before or tried to qualify for a line of credit? Or are you just now looking into what some of your options are and came across a few terms you aren’t familiar with?

- Compensating balances can act as a bridge, offering lenders greater security.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Specifically, it stipulates that debtors must maintain bank deposits that are equal to at least 20% of their outstanding loans.

- The strategic placement of these balances can be a nuanced aspect of financial management.

Can a bank charge interest on restricted cash balances?

Generally, the money held in the compensating balance account will be drawn from the principal of the loan itself, where it is then placed in a non-interest-bearing account provided by the lender. The bank is then free to use these funds for its own lending and investment purposes, without compensating the depositor. This restriction means the funds aren’t fully liquid, which can affect the company’s ability to quickly access cash.

Why You Can Trust Finance Strategists

The borrowing agreement states that the corporation will maintain a compensating balance in an account at the bank of at least $250,000. When the two sides of the arrangement are netted, the loan is actually $4,750,000. No, compensating balances are not always required, but banks commonly use them, especially for business accounts or larger transactions. Through online platforms, businesses can borrow directly from individual investors, bypassing traditional financial institutions.

Additionally, some lenders might have stricter requirements or offer limited flexibility regarding the linked account types. For businesses experiencing fluctuating cash flow, this readily available financial cushion can be invaluable. While the compensating balance restricts a portion of their liquidity, it provides a safety net and ensures access to credit when opportunities arise. For borrowers, accepting a compensating balance requires careful consideration. While the lower interest rate is tempting, the opportunity cost of the locked-in funds cannot be ignored. It’s crucial to weigh the benefits against the limitations and ensure the trade-off aligns with their financial goals.

Many lenders allow for automated sweeps, seamlessly maintaining the minimum balance by transferring excess funds from other accounts as needed. This eliminates manual monitoring and ensures compliance, streamlining financial processes and saving valuable time and resources. When you take out a loan from a bank, it is typically an installment loan — that is, a loan you pay off in several installments. Depending on your credit history, you may be required to keep a deposit of funds at the bank to qualify for the loan. This deposit is known as a compensating balance and reduces the bank’s total risk in making a loan. If you fail to repay the loan, the bank can seize the compensating balance.

Therefore, transparent communication about these balances in financial reporting is necessary to maintain stakeholder trust. Financial managers use various tools and software to aid in this decision-making process. Compensating balances are a financial tool that can influence the strategic planning of any business. They play a pivotal role in how companies manage their cash flow and credit facilities, often impacting the overall cost of borrowing. If you want to take out a loan or qualify for a line of credit, there are obligations for you to meet.

Smith’s Bank offers to provide a $110K line of credit with a $10K compensating balance on the average balance arrangement. Hotshot Fashions, therefore, has to pay interest on $10K each month, regardless of whether or not it accesses the line of credit. If it does access the line of credit it pays interest on what it borrows plus the $10K compensating balance. Compensating balances can serve as a strategic lever during financial negotiations, compensating balance loans offering a company the ability to potentially lower borrowing costs or secure more favorable terms. When entering negotiations, a firm’s understanding of its cash flow projections and financial standing informs its bargaining power. It’s not just about agreeing to a balance; it’s about leveraging it as part of a broader financial package that could include other elements like covenants, repayment terms, and interest rate adjustments.