Your NYSLRS plan differs from defined contribution plans, such as a 401-k plan, which are essentially retirement savings plans. In those plans, a worker, their employer, or both contribute to an individual retirement account. The money is invested and hopefully accumulates investment returns over time. This type of plan does not provide a guaranteed lifetime benefit and there is the risk that the money will run out during the worker’s retirement years. Experts recommend that workers who have defined contribution plans contribute anywhere from 10 to 20 percent of their income to their plan. NYSLRS members, in contrast, contribute between 3 and 6 percent of their income, depending on their tier and retirement plan.

Alternative #3: Peer-to-Peer Lending

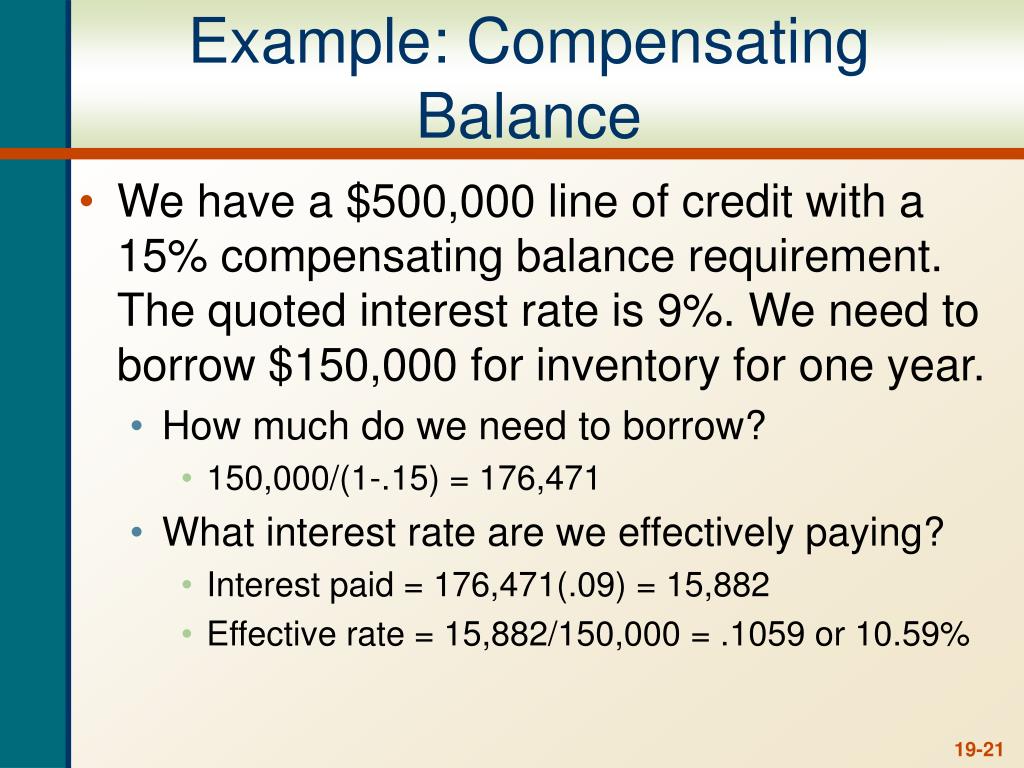

Although she is only free to use $8 million out of the $10 million she borrowed, Emily nonetheless must pay interest on the full $10 million loan. Effectively, this raises the cost of capital of her loan, while the opposite is true from the bank’s perspective. Let’s take compensating balance loans a closer look at what a compensating balance is and how it works, so you can understand how it may apply to your situation. Compensating balance is a balance that must be held with a lender in order for a borrower to be eligible for an installment loan or line of credit.

Presentation of a Compensating Balance Arrangement

Each option offers unique benefits and considerations, allowing companies to tailor their financial approach to meet their needs and goals. This buffer protects the bank by ensuring a portion of the loan remains readily available in case of default. Conversely, loans deemed less risky, like those secured by collateral, often have lower compensating balance requirements. Traditional loans often require collateral, which can be a major obstacle for some borrowers.

Which activity is most important to you during retirement?

This method provides some flexibility for borrowers, as they can adjust their balance levels throughout the period as long as the average meets the specified threshold. However, it also requires diligent monitoring to ensure compliance and avoid penalties. I’ll be your friendly navigator in this comprehensive guide I wrote, cracking the code of compensating balances.

By agreeing to maintain a specific minimum balance, borrowers unlock access to significantly lower interest rates than standard loans. This translates to substantial savings, especially on larger loan amounts. Imagine securing a business loan with a 2% interest reduction—a significant chunk of money freed up for other crucial endeavors.

The minimum balance acts as a guarantee, ensuring funds are readily available to cover withdrawals within the credit limit. At its core, a compensating balance is the minimum amount a borrower must keep in a designated account with the lender. Typically expressed as a percentage of the loan amount, this balance acts as collateral, mitigating the lender’s risk. While the borrower cannot freely use these funds, the lender earns interest on the full loan amount, recouping some perceived risk reduction.

Maintaining a compensating balance often involves additional administrative tasks, such as monitoring account balances and ensuring compliance with the terms. This can add to your workload and potentially incur additional fees, especially for businesses with complex financial operations. The requirement to consistently park funds acts as a gentle nudge towards responsible money management. It encourages careful budgeting, discourages impulsive spending, and fosters a habit of saving—all valuable skills that contribute to overall financial well-being. Importantly, the interest paid on the loan is based on the entirety of the loan principal, including any amount kept in a compensating balance. Even though the borrower is unable to withdraw or invest the $1 million (20%) compensating balance, they would still need to pay interest on that portion of the loan.

- Depending on your credit history, you may be required to keep a deposit of funds at the bank to qualify for the loan.

- Generally, the money held in the compensating balance account will be drawn from the principal of the loan itself, where it is then placed in a non-interest-bearing account provided by the lender.

- Compensating balances offer a viable alternative, reducing the need for additional security.

- Smith’s Bank offers to provide a $110K line of credit with a $10K compensating balance on the average balance arrangement.

Certain loan products, particularly lines of credit, might be contingent upon maintaining a compensating balance. These lines of credit offer borrowers flexibility, allowing them to tap into funds as needed without the hassle of repeated loan applications. They frequently appear in lines of credit, offering borrowers flexibility while protecting the lender.

If an escrow agentexpects to be paid for administering an escrow account or property, thematter of fees and reimbursement of expenses should be clearly set forth inthe escrow agreement. An escrow agent should provide the parties with a receipt for the escrowproperty, a copy of the escrow agreement and keep complete and accuraterecords. Depositors and beneficiaries have a right to a full accounting ofthe escrow agent’s management of the escrow property. If you’re interested in finding out more about compensating balances, then get in touch with the financial experts at GoCardless. Find out how GoCardless can help you with ad hoc payments or recurring payments. Smith’s Bank offers to lend them $110K with a $10K minimum fixed compensating balance.

This requirement, essentially a minimum deposit the borrower maintains, can seem perplexing. Why, when you’re borrowing money, do you need to keep some of it locked away? Understanding the seven key reasons lenders utilize compensating balances can illuminate this financial dance. This calculation reveals that while the nominal interest rate is 10%, the actual cost of borrowing—considering the funds that are tied up in the compensating balance—is 12.5%.

Connect with us for an hour online to receive your free financial education. For non-pension member employees who elect to contribute 7.5% or more to the Deferred Compensation Plan, DCP is their sole retirement plan in lieu of Social Security. Awards from the fund are generally madeafter a lawyer’s disbarment, and where it appears that the lawyer is unableto make restitution.